How much is my borrowing capacity

Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions. This comes to a total of 48000 CHF per year.

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationho Buying First Home Real Estate Investing Rental Property Home Buying

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

. Currently the rate for this scheme is 525 and compound interest is charged. It uses a median expenditure on basic expenses eg. Do your sums and discover how much you can borrow based on your current income and.

Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Your borrowing power will vary between banks and lenders. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

The borrowing capacity calculator will help give you the confidence to purchase your home. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after. For this reason our calculator uses your.

2000 cashback when you refinance to. There is a big difference. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration.

Compare home buying options today. The maximum amount you can borrow may be lower depending on your LTV and following our. If you want a more accurate quote use our affordability calculator.

This calculator helps you work out how much you can afford to borrow. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

Your maximum borrowing capacity is approximately AU1800000 The two examples above demonstrate how. The figure may become part of a lenders calculation when assessing your borrowing capacity. The borrowing base is usually determined by a.

About 380000 less After going through the above three tables we hope that you have. Remember that your borrowing power will vary from lender to lender. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

For a conventional loan your DTI ration cannot exceed 36. View your borrowing capacity and estimated home loan repayments. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Looking at it the other way round taking. Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus. If youre not sure just put an estimate. A maximum of 2 applicants can apply for a new HSBC mortgage.

The combined revenue of the borrowers must therefore be at least 144000 CHF. Borrowing capacity is the maximum amount of money you can borrow from a loan provider.

General Surety Bonds Information Infographic Party Fail Commercial Insurance

My 2019 Reading List What Are You Reading Planning On Reading This Year Becoming A Mum 4 Years Ago Made My Ability To Reading Lists Books To Read How To Plan

A Balancing Act A Cicero Group Briefing On The Uk Budget 2013 Infographic Budget2013 Infographic Budgeting Infographic Design

Subtraction With Borrowing Poem Second Grade Math Teaching Support First Grade Math Teaching Classroom

Realtor Thanksgiving Kellerwilliams Homeownerhip Thanksfulforlist Benefitsofhomeownership Home Ownership The Borrowers Home Selling Tips

How To Create A Learning Objectives Display In Elementary Learning Objectives Learning Objectives Display Objectives Display

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

Pin On Getting Organized

Dyscalculia In 2022 Dyscalculia Math Operations Learning Difficulties

Nyc Gift Letter For Mortgage Hauseit Letter Gifts Lettering Letter Templates

Pin On Go Math 16 1 Grade 8 Answer Key

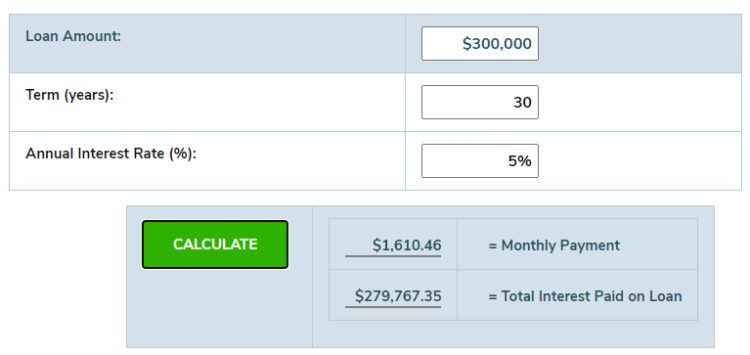

Loan Interest Calculator How Much Will I Pay In Interest

Povdmfq8xbblpm

Home Loan Borrowing Power Wells Fargo

Pin By Damien Williams On Capital Debt Chart Day

Loan Calculator Credit Karma

Cultural Appreciation Vs Appropriation Cultural Appropriation Work Train Culture